What Happens When Federal Spending Cuts Slam the States?

This week’s 2017 Fiscal Summit, sponsored by the Peter G. Peterson Foundation in Washington, DC, saw US Senate and House leaders of both parties pore over President Donald J. Trump’s budget, tax, and health-insurance plans and their impact on an economy closing in on an eighth straight year of recovery from the Great Recession. What we should have heard more of during the discussions was the effect of the Administration’s dramatic federal tax and spending cuts on the fifty states.

According to the New York Times, the Trump budget would reduce Medicaid spending by more than $800 billion over the next decade, along with $192 billion in cuts to nutritional assistance and $272 billion for welfare. The Medicaid cuts alone represent “a new cost shift from the feds to the states,” Senator Mark Warner, a Virginia Democrat, told CNN reporter Dana Bash during a question-and-answer session at the Summit. “I would be outraged.”

That the White House and Congress appear to pay little heed to state budgets is hardly new; the 2013 budget sequestration deal delivered an unpleasant surprise to Virginia, for example, as its budget got hit with unexpected losses in federal largesse. However, the impact of Washington’s spending decisions on the states is profound. States generate more than $2 trillion in annual expenditures, accounting for 11 percent of US gross domestic product. Already, state revenue growth since the last recession ended in 2009 has slowed to about half the rate it recorded following the previous recession’s end in 2001. More budget-slashing by the federal government can’t help but pressure states, counties, and cities to follow suit. While the White House predicts 3 percent real GDP growth will result from its policies, the reality may be somewhat different as government spending retreats.

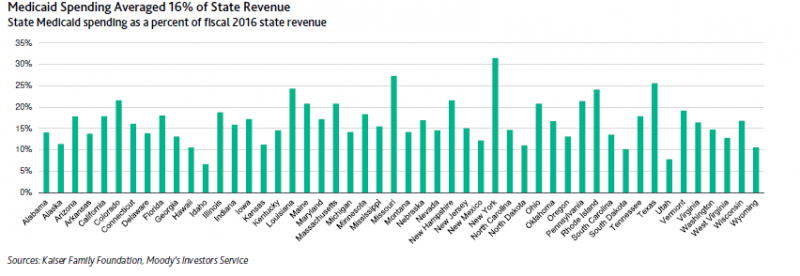

As this chart from Moody’s Investors Service shows, Medicaid, a joint state-federal program, makes up 16 percent of state revenue, on average.

Moody’s expects the Medicaid reductions will "pressure state governments to take various actions to balance their budgets, including adjusting Medicaid eligibility rules, increasing their own funding of Medicaid, or cutting payments to hospitals and other providers. Hospitals would be negatively affected by likely reimbursement cuts and eligibility changes that states would implement as a result of the reduced federal funding."

“Less is less,” New Orleans Mayor Mitch Landrieu told the Summit. “You can’t do more with less.”