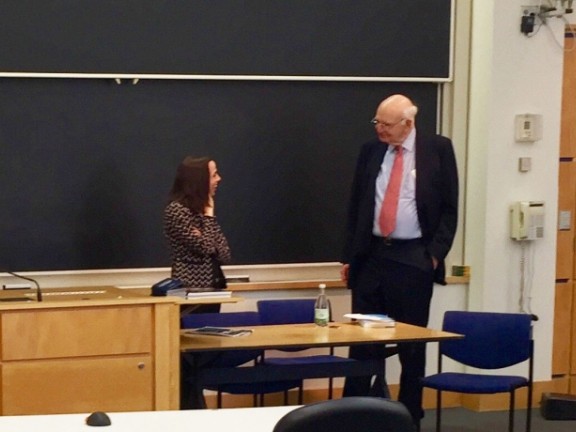

Volcker Speaks with Columbia Law Course on Central Banking

On Thursday, March 31, Paul Volcker engaged in discussion on central banking and regulatory accountability with a Columbia Law School Reading Group on Central Banking that aims to critically analyze the function and oversight of central banks. The objective of the reading group, led by Profesors Kathryn Judge and Georges Ugeux, is to discuss the accountability deficit with respect to the Federal Reserve System revealed by the 2007-2009 financial crisis. The course focuses on “how best to balance the welfare benefits that can arise from having a central bank with significant discretion and authority with the transparency and accountability demands of a democratic regime.”

The 2015 Volcker Alliance report Reshaping the Financial Regulatory System outlines recommendations for regulatory reform that Mr. Volcker discussed with the students. He said there is still “great vulnerability” in the financial system, exacerbated by ongoing “rampant abuse” of security lending. He described the high levels of debt resulting from intra-financial activities and noted that “We have a financial system once accounting for almost 40 percent of all the profits in the country which raises questions about if this makes sense. It generates billions of dollars for a limited amount of people.”

Mr. Volcker also discussed threats outside of the commercial banking system, and the federal government’s current inability to supervise these activities effectively. “You had this attempt in Dodd-Frank to deal with regulatory supervisory needs, but [legislators] only made a few changes because they couldn’t, in the time available, revise the entire system. The focus was to strengthen the existing regulatory structure, not to rationalize its framework. Dodd-Frank was a recognition, however, that we have to deal with issues outside of the commercial banking system and extend regulation to cover [those activities].”

At the root of the inability to move toward a risk management approach is the need to first overcome the limitations inherent in the US government’s three-branch regulatory structure, according to Mr. Volcker. “People have been unhappy with administrative layout in this country for decades. Too many overlapping agencies and too many “loopholes” decrease effectiveness as well as accountability, so regulatory ineptitude is built into the system. And then we have the new organizational authority—like the Financial Stability Oversight Council—which lacks power beyond recommendations. If we can combine supervisory functions but keep it close to the Federal Reserve, it will be a step in the right direction.”