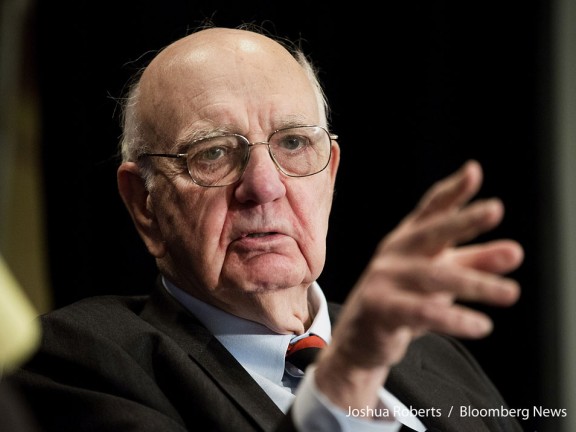

Volcker Outlines Need for 'Sensible' Changes in U.S. Financial Regulation

In remarks at George Washington University March 20, Volcker Alliance Chairman Paul Volcker discussed the need for “sensible” changes in the way the U.S. government oversees the nation’s financial industry. The recent financial crisis, he said, “exposed just how rickety and out of date our regulatory and supervisory framework is.”

The former Federal Reserve Board Chairman, who founded the Volcker Alliance in 2013 to address the challenge of effective execution of public policies and help rebuild public trust in government, said that for the regulatory system, the 2008 crisis exposed a “pattern of inconsistencies, overlaps and gaps, differing priorities, squabbling over turf, competition in laxity, and particularly lack of coherent oversight of financial innovations outside the banking system has been revealed in all its ugliness.”

Said Mr. Volcker: “Ask anybody whether the existing system makes sense. The virtually unanimous answer is no. Ask the people about the prospects for change, there is equal unanimity; the answer is none.”

In citing the “clear need for effective surveillance and oversight of the financial system,” Mr. Volcker noted that “individual financial institutions have become of enormous size, harder to manage, infused with conflicts of interest and compensation practices that challenge the very caveat of fiduciary responsibility. Then there is turf to be protected – both supervisory turf and political turf.”

THE FED AS REGULATOR CONFERENCE Keynote Address by Paul Volcker from Volcker Alliance on Vimeo.