New York, Other States May Be Getting Shortchanged by $1 Trillion in State Tax Breaks, New Economic Analysis Shows

New Volcker Alliance Issue Paper Examines If Massive Tax Breaks Are Beneficial or Leaving States Short on Critically Needed Revenue

New York, NY – Today the Volcker Alliance released an Issue Paper that examines whether the massive tax breaks that U.S. states hand out every year may be leaving states short on critical revenue they may need to spend on important and necessary projects in the short term such as climate preparedness and infrastructure. States provide these tax incentives to spur business investment, create jobs, or advance policy goals, such as aiding low-income families.

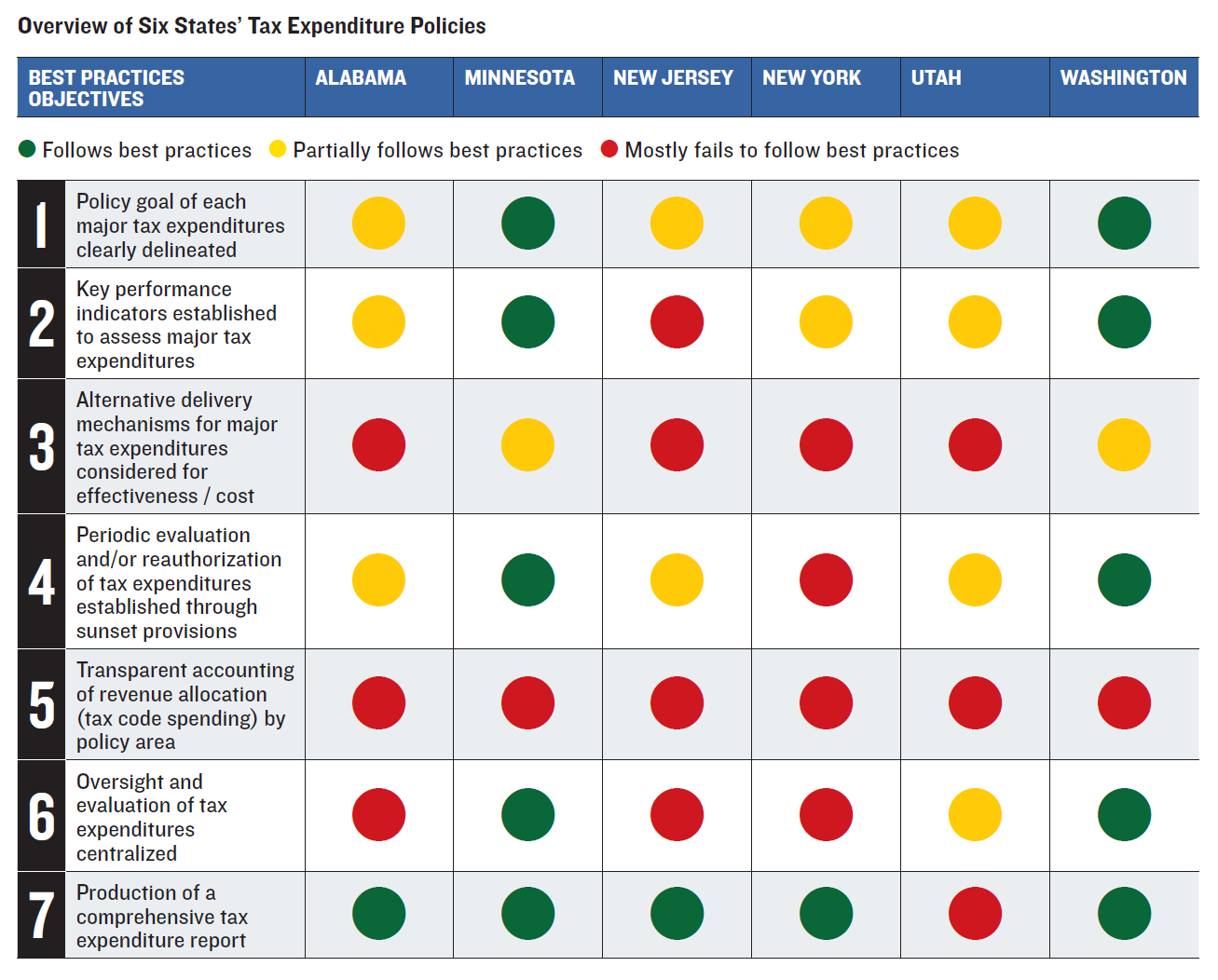

The paper, Benefit or Burden: Evaluating $1 Trillion in State Tax Expenditures, examines the present and predicted effects of such massive tax breaks, which often lack rigorous oversight, and offers scorecards comparing the reporting methods of six states with widely differing policies: Alabama, Minnesota, New Jersey, New York, Utah, and Washington.

“Tax expenditures on the state level are not nearly as transparent as they should be,” said Matt Fabian, one of the paper’s authors and partner at Municipal Market Analytics Inc. (MMA). “These expenditures are often not subject to the same rigorous review as direct spending is subjected to during states’ budgeting processes, which can lead to a cycle where expenditures continue indefinitely and create a disproportionate impact on state revenue-raising capabilities.” The paper was co-authored by Lisa Washburn, Managing Director at MMA.

According to the paper, tax expenditures decrease state revenues by as much as $1 trillion annually, nearly three times the total state spending on education nationally in 2021. The paper offers recommendations for states wishing to improve their evaluation and disclosure of tax expenditures. They include:

- States should clearly delineate the policy reasons for each major or policy-critical tax expenditure and consider the cost and reasonable effectiveness of alternative policy choices (such as direct spending) to achieve the same policy goal.

- States should create key performance indicators (KPIs) to evaluate every major tax or policy critical expenditure to help gauge whether they are satisfying the original or amended policy goal.

- States should set standard sunsetting provisions for every state tax expenditure and periodically assess those that relate to federal tax code conformance.

- States should produce a resource allocation budget that reports direct spending and tax expenditure estimates by budget category and provides a fuller accounting of where potential resources are being directed.

- States should deploy permanent, professional staff and administrative resources to analyze and track tax expenditures.

According to the paper, all 50 states fail to follow best practices when it comes to transparently accounting for their tax expenditures. The table below assesses the six states’ tax expenditure policies. According to the report findings, Washington is leading in best practices, while New Jersey and New York are falling short on several of the recommended best practices.

“States have a duty to establish tax policy that works in the best interest of the taxpayers,” said William Glasgall, the Volcker Alliance’s senior director of public finance at the Volcker Alliance. “All states, especially the ones examined in this report, need to spend more time assessing which expenditures are truly advancing important policy goals and which are not.”

The full issue paper is available here.

###

Media Inquiries, please contact: Ariel Sussman | [email protected] | 978-807-7950