Kicking the Can on Infrastructure Leaves the U.S. Poorer in the End

I’m reminded of America's infrastructure spending gap almost every morning as I sit on my regular 7:33 a.m. New Jersey Transit train creeping its way under the Hudson River to New York. The two parallel railroad tunnels near the end of my ride date back to 1910 and are clogged with hundreds of thousands of local commuters and long-distance Amtrak passengers every day. But no relief is in sight.

The struggle in and out of America’s biggest city shows the consequences of Congress, governors and legislators across the U.S. pushing the burden of today’s costs onto the backs of tomorrow’s taxpayers by repeatedly putting off infrastructure repairs and new construction. The American Society of Civil Engineers says this reluctance to spend will result by 2020 in a $3.6 trillion tab for needed work on such things as highways, bridges, dams, water-treatment plants, schools and railroads.

If you think you’ve heard this before, you’re right. “Every American lives with the consequences of decades of underinvestment, including congested and deteriorating highways, unsafe bridges, inadequate transit and intercity rail systems, delayed flights and bottlenecked seaports,’’ the America 2050 project reported back in 2008. Six years later, it’s even more apparent that the spirit that built the Interstate highway system has vanished. In this time of tight budgets and pension costs consuming bigger shares of state and local budgets, it’s a rare politician who wants to borrow money to build new bridges or railroads, much less boost taxes or spending to fund them.

“There is nothing politically sexy about infrastructure spending,” Janney Montgomery Scott municipal bond analyst Tom Kozlik wrote recently as he bemoaned a “lack of broad federal, state, local government and voter support.”

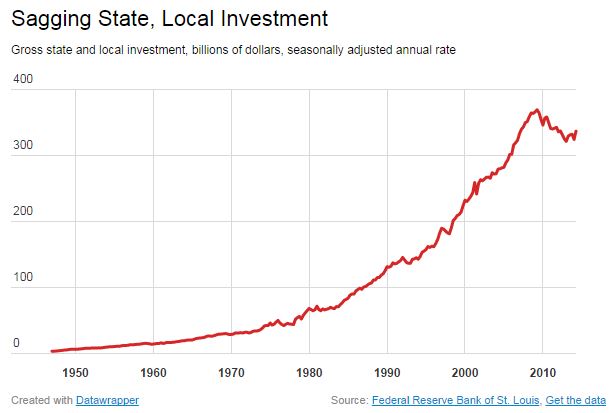

Federal spending on infrastructure has fallen to a 20-year low of 1.7 percent of GDP, according to the Standard & Poor’s. State and local gross investment, after jumping under President Barack Obama’s stimulus program, has fallen back to where it was in 2007, on the eve of the last recession, after growing almost without interruption since 1947, St. Louis Federal Reserve Bank data show. And while there’s been a small recovery in 2014 since spending bottomed last year, the outlook for state and local bond sales, which largely finance capital projects, doesn’t give much hope for a big recovery in infrastructure investment.

Issuance of long-term, fixed rate state and local debt in the $3.7 trillion U.S. municipal bond market is on pace for a third straight annual decline. Citibank analyst George Friedlander projected in July that states and localities will sell only $315 billion this year, down from $333 billion in 2013 and $376 billion in 2012. Kozlik says borrowing might not even surpass $275 billion in 2014, and then fall by nearly half in the next three years, to $175 billion, if increasing interest rates further saps municipalities’ appetite for new debt.

Given the reluctance by Congress to pass a long-term fix for the financial ills of the Federal Highway Trust Fund, the Obama Administration is promoting public-private partnerships as a way to get the bulldozers humming. Yet a recent House Transportation and Infrastructure Committee report concludes that such deals need generous help from U.S. taxpayers in the form of subsidized Transportation Infrastructure Finance and Innovation Act loans and tax-exempt private activity muni bonds, the Bond Buyer newspaper reported.

Shifting costs from states, counties and cities to private investors won’t get our infrastructure fixed. And don’t count on politicians obsessed with deficits and getting reelected stepping up to the plate. In 2010, Republican New Jersey Governor Chris Christie had no qualms about killing a second set of Hudson rail tunnels that could have speeded commuting and benefited the region’s economy. That project would come in really handy now that officials are talking about shutting one of the current tunnels in a couple of years for repairs to damage caused by Superstorm Sandy.

Maybe we should call infrastructure something else to make it more politically palatable. How about “Job Creator.” Or “Economic Engine.” A new name can’t hurt, and the cost to Americans of deferring critical spending is getting bigger by the day.